|

THE BLOT REPORT

Sunday, August 24, 2025 - 14:54

Source

|

THE BLOT REPORT

Sunday, August 24, 2025 - 14:52

Source

|

|

Your Democracy

Sunday, August 24, 2025 - 08:42

Source

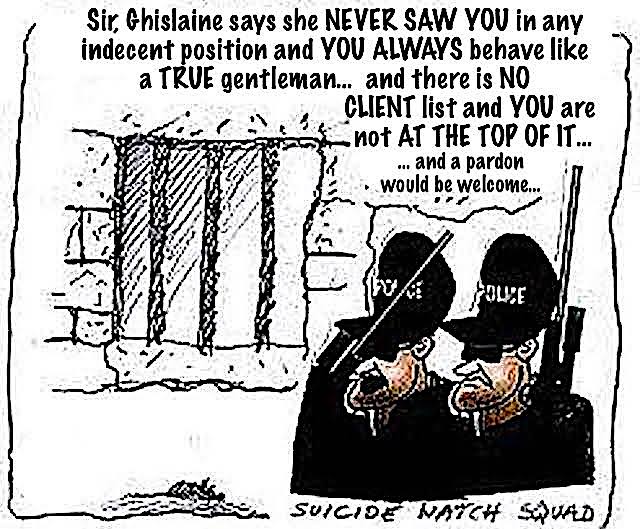

Convicted sex trafficker Ghislaine Maxwell, who is seeking a pardon from Donald Trump, told top Justice Department officials during an interview last month that she never witnessed the president “in any inappropriate setting” with girls introduced to him by disgraced financier Jeffrey Epstein.

|

Your Democracy

Sunday, August 24, 2025 - 08:11

Source

The German economy is experiencing a “structural crisis” rather than just temporary “weakness,” Chancellor Friedrich Merz has said, admitting that steering the country’s economy back on track has proven harder than he had anticipated. Merz made the remarks on Saturday in a speech before members of his Christian Democratic Union party in the Lower Saxony city of Osnabrueck, the home state of major carmaker Volkswagen. |

|

Your Democracy

Saturday, August 23, 2025 - 16:55

Source

I have entered the age of incomprehension Possibly because of the infernal confusion Up there in my old lofty pigeon Due to a blow from a truncheon Not even wearing an hearing aid Would sort this inner devil afraid Did she say a bunch of arseholes Or announced the next batch of households Should I say I am too old for this piss As Donald trumpets talks of peace When I understand nothing any more |

Renew Economy

Saturday, August 23, 2025 - 07:36

Source

|

|

Renew Economy

Friday, August 22, 2025 - 12:56

Source

|

MacroBusiness

Friday, August 22, 2025 - 11:00

Source

The ferrous complex is trying to hold $100. I expect it to fail. Not on anything especially dramatic. Largely because the seasonal headwinds for September are strong amid weakening Chinese growth. Goldman. Imports pulse is weak. Surprises bearish. Construction steel versus the rest means ongoing pressure on recycling but seasonality should also pull down BOF. It’s The post Iron yawn appeared first on MacroBusiness. |

|

Renew Economy

Friday, August 22, 2025 - 10:31

Source

|

MacroBusiness

Friday, August 22, 2025 - 10:30

Source

The Market Ear. Watching the sensitive stuff ETH trying to tell tech something? These two have moved in perfect tandem over the past 2 months, but the latest gap is becoming very wide. Source: LSEG Workspace The worrisome part of the calendar The S&P 500 down 5 days in a row – front-running the calendar The post Stocks set up for punishment appeared first on MacroBusiness. |

|

MacroBusiness

Friday, August 22, 2025 - 09:30

Source

DXY is back. AUD has entered freefall. CNY is fine. Gold is confused. Metals are nervous. Big bear intact. EM swoon. Junk hiccupped finally. As yields broke higher. Stocks kept falling. There wasn’t any earthmoving data. All eyes are on Jay Powell. Goldman says he’s going to break. Goldman economist David Mericle expects Powell to The post Australian dollar enters freefall appeared first on MacroBusiness. |

Your Democracy

Friday, August 22, 2025 - 08:50

Source

|

|

Your Democracy

Friday, August 22, 2025 - 08:04

Source

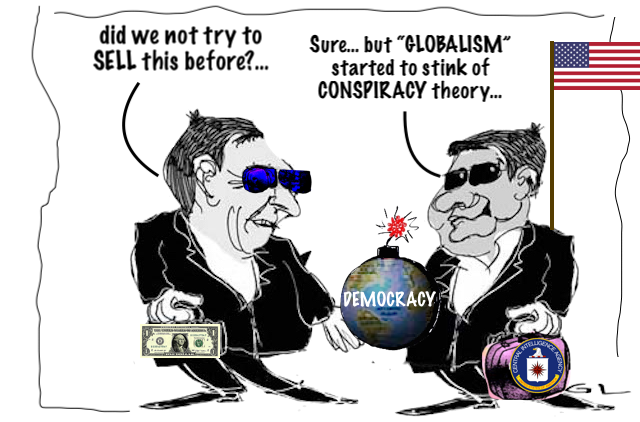

A German opposition leader has accused the EU of hypocrisy, pointing out that those who once rejected dialogue with Moscow are now praising US President Donald Trump’s diplomatic efforts to settle the Ukraine conflict. |

Your Democracy

Friday, August 22, 2025 - 07:33

Source

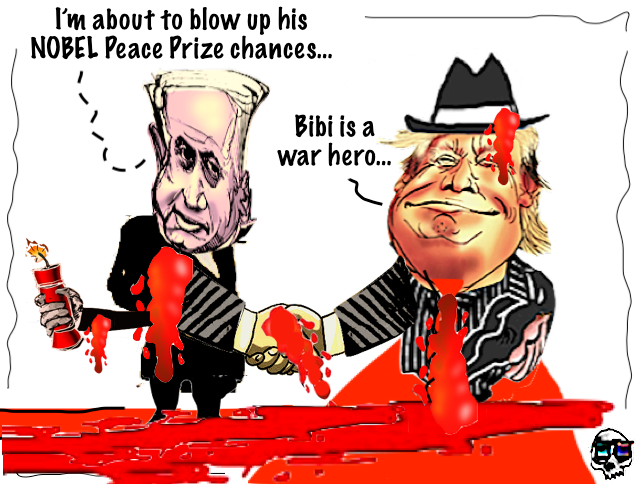

Israel’s decision under its fanatic ethno-nationalist government to both approve more West Bank settlements and invade Gaza City now tragically defines the whole Zionist project: a 70-year campaign to purge Palestinians and create a greater Israel. Netanyahu’s criminality now defines Israel’s mission and recasts its history.

|

|

MacroBusiness

Thursday, August 21, 2025 - 16:30

Source

Australian stocks led the way to a new record high today but the rest of Asian share markets were mainly down across the board as risk sentiment continues to shift further into negative space as we all await the Jackson Hole conference tomorrow. The USD remains on a small rally against the majors although Euro The post Macro Afternoon appeared first on MacroBusiness. |

Renew Economy

Thursday, August 21, 2025 - 14:39

Source

|

|

Renew Economy

Thursday, August 21, 2025 - 14:31

Source

|

Renew Economy

Thursday, August 21, 2025 - 14:24

Source

|

|

Renew Economy

Thursday, August 21, 2025 - 14:15

Source

|

MacroBusiness

Thursday, August 21, 2025 - 13:00

Source

APA Group with the news. AFR. The chief executive of the country’s biggest gas transporter, APA Group, has fired off against plans to import LNG to avert a potential gas shortage, warning that the high cost of imports risks turning consumers and industry against gas altogether. Adam Watson said importing liquefied natural gas into the The post LNG imports “ludicrous” appeared first on MacroBusiness. |

|

MacroBusiness

Thursday, August 21, 2025 - 12:30

Source

There is nothing a central banker likes more than to waste money while forcing everybody else into austerity. The cost of renovating the RBA’s asbestos-ridden head office in Sydney’s Martin Place has risen to $1.2 billion, prompting the newly installed governance board to consider selling the building and walking away from the troubled project. The The post The RBA’s big, black building appeared first on MacroBusiness. |

MacroBusiness

Thursday, August 21, 2025 - 12:05

Source

Join us this week as Nucleus Wealth’s Chief Investment Officer, Damien Klassen and distressed debt manager Jonathan Rochford run through the problems facing Australia and it’s tumble down the productivity tables. Can’t make it to the live series? Catch up on the content via Podcasts or our recorded Videos. Damien Klassen is Chief Investment Officer at the Macrobusiness Fund, |

|

MacroBusiness

Thursday, August 21, 2025 - 12:00

Source

With the release of the Reserve Bank of Australia’s (RBA) latest Statement on Monetary Policy last week, the media focus was swiftly placed squarely upon the RBA’s forecast that productivity growth would be anaemic 0.7% per year on a long-term time horizon. But buried in the RBA’s lengthy forecast table was perhaps an even more The post RBA forecasts sets scene for raining rate cuts appeared first on MacroBusiness. |

Your Democracy

Thursday, August 21, 2025 - 10:40

Source

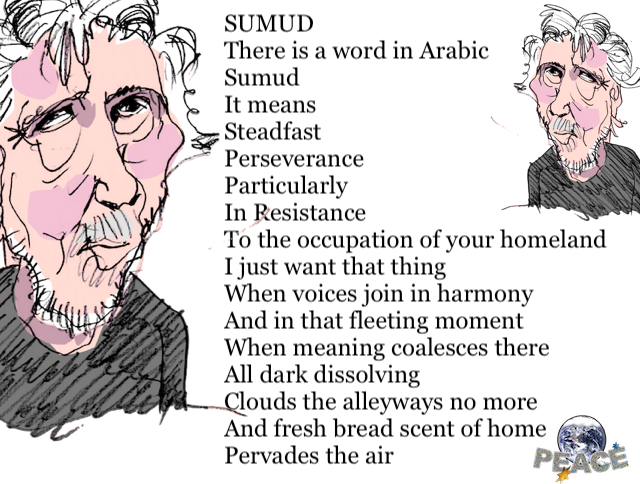

Last week, during a video posted on YouTube for the War Abolisher Awards, Roger Waters shared a new song titled "Sumud." SUMUD There is a word in Arabic Sumud It means Steadfast Perseverance Particularly In Resistance To the occupation of your homeland I just want that thing When voices join in harmony And in that fleeting moment When meaning coalesces there All dark dissolving |

|

MacroBusiness

Thursday, August 21, 2025 - 10:00

Source

DXY is refusing to go away. AUD is going away. CNY not. I’m wary of gold here. Metals dead cat. Miners plain dead. EM rolling. Junk doesn’t care. Yields are falling in a growth scare. Stocks could catch that bug. At issue is a Fed that the market has gotten wrong. In their discussion of The post Australian dollar pushed to brink by Fed growth scare appeared first on MacroBusiness. |

MacroBusiness

Thursday, August 21, 2025 - 09:06

Source

Growth! S&P flash PMI. Flash Australia Composite PMI Output Index: 54.9 (Jul: Index, sa, >50 = growth m/m % qr/qr 53.8) Flash Australia Services PMI Business Activity Index: 55.1 (Jul: 54.1) Flash Australia Manufacturing PMI: 52.9 (Jul: 51.3) Flash Australia Manufacturing PMI Output Index: 53.9 (Jul: 52.3) Australia’s business activity growth accelerated midway through the |

|

MacroBusiness

Thursday, August 21, 2025 - 09:00

Source

Overnight saw Wall Street stumble again, as big tech stocks couldn’t do the heavy lifting while European markets also pulled back slightly although the rising FTSE was an outsider. The release of the latest FOMC meeting minutes saw them highlight inflation and tariff risks with politics pushing in again as the Trump regime places pressure The post Macro Morning appeared first on MacroBusiness. |

Renew Economy

Thursday, August 21, 2025 - 07:14

Source

|

|

Your Democracy

Thursday, August 21, 2025 - 06:55

Source

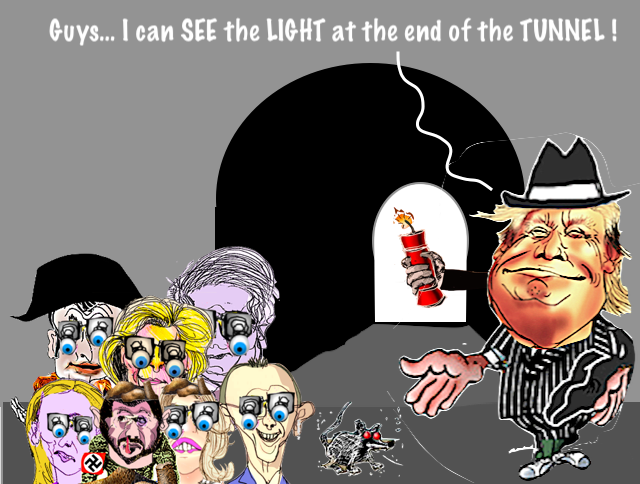

I think I am in a bad dream and soon I will wake and find Donald J. Trump didn’t happen. I listen to hours of podcasts where pundits try to make sense of this creature. Like Atlas, he holds the world on his shoulders. Will he be doomed like the Titan God or smash us all before he is done?

|

Your Democracy

Thursday, August 21, 2025 - 06:44

Source

US President Donald Trump has called Benjamin Netanyahu “a war hero” as the Israeli prime minister faces a global backlash over the Gaza humanitarian crisis and the Jewish state’s continued military campaign in the Palestinian enclave. In an interview with conservative commentator Mark Levin on Tuesday, Trump called Netanyahu “a good man”who he said is “there fighting.” |