The Market Ear on the rally. Not too bad The 6 day SPX streak has actually been rather impressive. As John Flood writes: “Since 1970, S&P 500 up 6 days in a row with returns of over 7% has only happened 12 times. Post yesterday’s close we locked in # 13. We are due for a

The post Rallying on fumes appeared first on MacroBusiness.

The latest State of the Land Report 2025 from the Urban Development Institute of Australia (UDIA) forecasts that the nation’s housing crisis will worsen as demand from population growth (immigration) continues to outrun housing construction: UDIA’s long-run analysis of national population and dwelling growth highlights a serious divergence in new dwelling supply not keeping pace

The US share markets were mixed on Wednesday after data showed the US economy contracted in the March quarter for the first time in three years. The decrease underscored concerns about the impact of US tariffs and the global trade war on growth. The Dow Jones index rose by 142 points, or 0.4%, and the

The post Australian dollar bunkers down appeared first on MacroBusiness.

The latest US GDP print for Q1 came in worse than expected, sending Wall Street down 2% at one stage before the hopium set in as markets recovered towards the close on reports of a possible Canadian deal with the new PM. The USD was mixed against the majors with some return to strength against

The post Macro Morning appeared first on MacroBusiness.

When I first heard that there was to be a shadow cabinet reshuffle from the leader of the Liberal Party, Peter Dutton, I was not particularly interested given that most of the shadow cabinet are inept or corrupt. However, when I heard that Gina Rinehart had said on January 22, 2025, that “if we are sensible, we should set up a DOGE [Department of Government Efficiency] immediately, reduce government waste, government [red] tape and regulations, I was unsurprised, being as she is a big Trump supporter, and even travelled to the US to kiss his ring at his inauguration1.

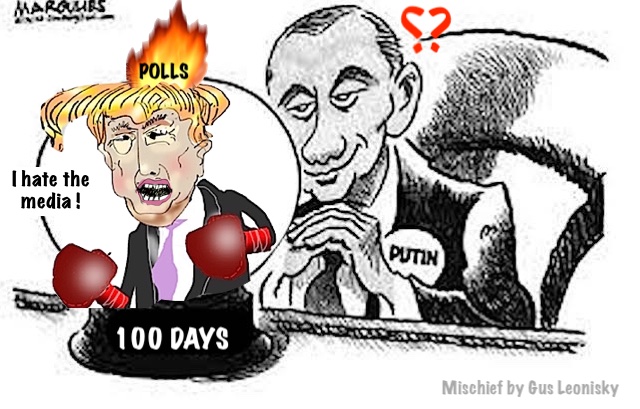

New polling demonstrates that most voters see President Donald Trump as a dangerous politician and view his leadership style as dictatorial.

The Australian Bureau of Statistics (ABS) Q1 CPI release revealed that housing inflation is slowing rapidly, contributing to lower trimmed mean inflation. CPI rental inflation rose by 1.2% in Q1 but moderated to 5.5% growth annually. The annual rate of growth was down from the peak of 7.8% in Q1 2024. The following chart from

The post Housing a welcome drag on inflation appeared first on MacroBusiness.

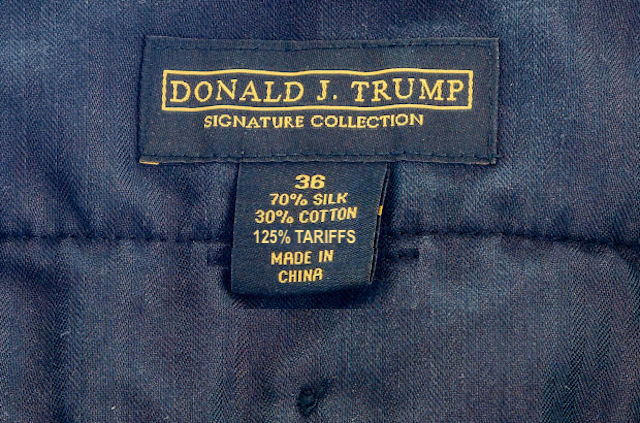

The mainstream Western media and global, alternative media outlets have been delivering a remarkable converging stream of blistering commentary since 2 April on what is now widely called, even by The Economist, Trump’s tariff tantrum.

The Irish-language hip hop trio Kneecap is being investigated by British counterterrorism police following a controversial appearance where the group performed in front of the words “FUCK ISRAEL, FREE PALESTINE” during a music festival in the United States.

Back in 2022, after my first encounter with ChatGPT, I suggested that it was likely to wipe out large categories of “bullshit jobs”, but unlikely to create mass unemployment. In retrospect, that was probably an overestimate of the likely impact. But three years later, it seems as if an update might be appropriate.

Australia’s productivity growth has averaged just 0.2% a year over the last decade. Labor’s first budget in 2022 included the assumption that productivity growth would average 1.2% over the long-term. The Coalition contends that annual GDP would be about $250 billion higher if productivity had grown at this pace, while annual tax revenue would have