Santos runs two LNG export trains out of Gladstone, Queensland, which siphons up East Coast gas and ships it to Asia (mostly China). Since Santos’ LNG export trains came online in 2015 (alongside others), the volume of gas produced on the East Coast has doubled, while 25% less gas has been supplied to domestic users.

The post Abu Dhabi launches takeover of Australian gas appeared first on MacroBusiness.

Policy makers and economists are concerned that the retirement of the Baby Boomer generation and an ageing population could see the nation’s workforce heavily diminished in the future. For example, Federal Treasurer Jim Chalmers warned in January 2023, just as immigration was ramping to record levels, that longer life expectancy and a sharp decline in

Anybody who believes that meeting Labor’s 82% Renewable Energy Target (RET) by 2030 is achievable or affordable is delusional. To achieve Labor’s fantastical target, most of Australia’s baseload coal generation—the backbone of the nation’s electricity grid—would need to be shut down and replaced with intermittent and weather-dependent wind and solar generation, backed up with battery

May Chinese credit was soft. The recent acceleration in total social financing stalled at 8.7% year-on-year stock growth. And don’t forget that a lot of this is debt swaps with local governments, so the real number is more like 8%. Other indicators are pretty soft as well. Power is tepid. Tourism remained tepid. Exports are

The post Chinese credit and economy slide appeared first on MacroBusiness.

How long can steel fall and iron ore not? Coking coal is still sliding as well, which offers some explanation. Flat steel demand remains stagnant. Long steel is wrecked. Output is getting pulverised. One wonders if the mooted 50 mt in output cuts are taking effect. The steel market appears sick.

The post Iron ore market sickens appeared first on MacroBusiness.

Markets are half-panicked by the latest Middle East war. Oil Israel’s attacks on Iranian air defense systems and nuclear capabilities re-opens awide range of possible avenues via which oil supply could be disrupted. Importantly, it may also derail the process of US-Iran nuclear deal talks which were scheduled to continue in Oman on Sunday, although

Ah, the gas cartel, that wondrous beast that knows no bounds of decency. Via Petroleum Australia: Australia Pacific LNG (APLNG), the country’s largest liquefied natural gas exporter on the east coast, has agreed to a substantial price reduction under its flagship 7.6 million tonne per annum contract with China’s Sinopec. The move, anticipated to cost

Friday’s session was dominated by the Israeli-Iranian war with an initial flight to safety to USD that then faded, coupled with an actual rise in Treasury yields. This is not usual in times of high risk and is a symptom of the flailing global monetary order. The 30 year yield finished close to the 5%

The post Macro Morning appeared first on MacroBusiness.

I am philosophically opposed to taxpayers providing subsidies for private car transportation. Most of these subsidies flow to higher-income earners. Therefore, these subsidies serve as a prime example of the reverse Robin Hood phenomenon, where the rich benefit at the expense of the poor. Electric vehicle (EV) subsidies are exceptionally costly and egregious. The Fringe

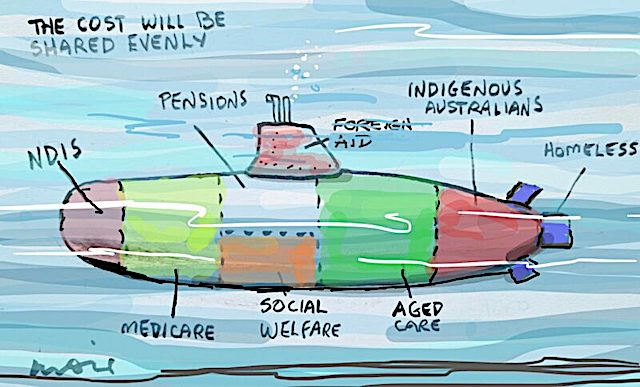

After more than four years, the Information Commissioner has compelled the Defence Dept. to hand over information sought about expert advice on Australia’s Naval shipbuilding program. Rex Patrick reports.