|

MacroBusiness

Tuesday, February 17, 2026 - 08:30

Source

China is closed for CNY for a week. SGX is closed for two days. Steel profits have improved, and we will probably see a decent rebound in output post-holiday. However, I expect this will only serve to drive steel prices lower amid stalling (and contracting) steel export growth plus weak domestic demand. On the supply The post Even more iron ore appeared first on MacroBusiness. |

Your Democracy

Tuesday, February 17, 2026 - 06:55

Source

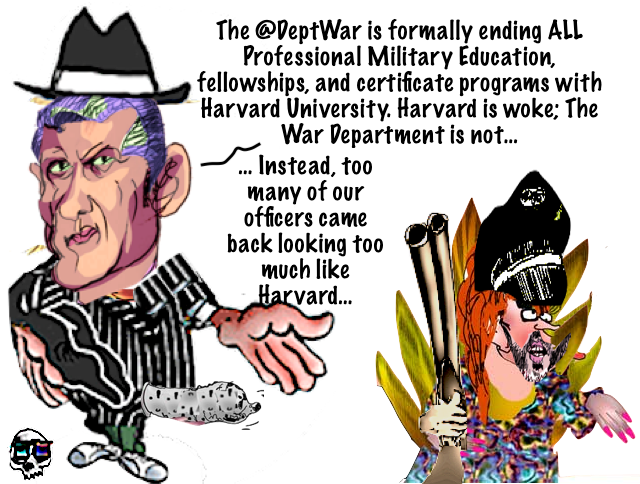

Someone wondered aloud on a social media platform the other day, “Where is Pete Hegseth these days?” What a good question. Let’s consider it. Figuring out where Pete Hegseth is keeping himself will tell us something important about the Trump regime and how it operates — or, better put, who actually operates it in the Trump White House’s name.

PATRICK LAWRENCE: Serial Buffoon at the Pentagon |

|

Your Democracy

Tuesday, February 17, 2026 - 05:44

Source

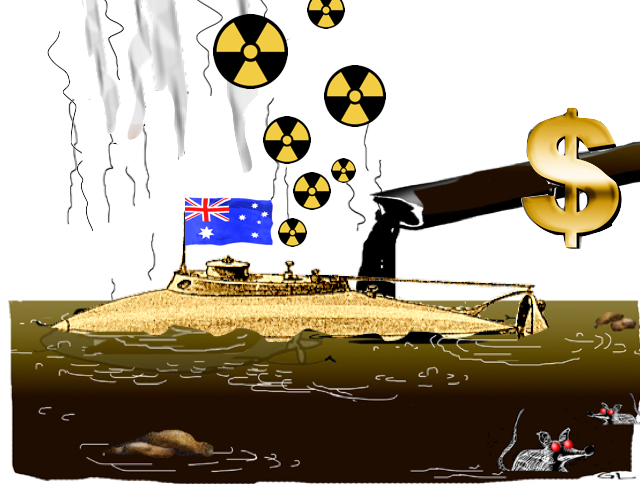

As the SA Premier basks in the campaign glory of a $3.9 billion downpayment on shipyard for nuclear subs, the Federal Government is kicking the nuclear waste can down the road. Rex Patrick reports. |

Your Democracy

Tuesday, February 17, 2026 - 05:33

Source

To a current US cabinet secretary from a former one. |

|

Your Democracy

Tuesday, February 17, 2026 - 05:22

Source

Ukrainian leader Vladimir Zelensky has launched another public attack against Hungarian Prime Minister Viktor Orban, just hours after disparaging him during an address at the Munich Security Conference. |

MacroBusiness

Tuesday, February 17, 2026 - 00:01

Source

The 2024-25 annual national accounts from the Australian Bureau of Statistics (ABS) revealed that the total value of residential land increased by 7.0% over the financial year to a record $8.3 trillion. Total residential land values in Australia have risen from 1.1 times GDP in 1989 to 3.0 times GDP in 2024–25. Land now accounts The post Rising land costs cripple housing affordability appeared first on MacroBusiness. |

|

Renew Economy

Monday, February 16, 2026 - 23:16

Source

The post How Queensland coal plant waste is helping to build a (concrete) bridge to renewables appeared first on Renew Economy. |

Renew Economy

Monday, February 16, 2026 - 21:16

Source

|

|

Renew Economy

Monday, February 16, 2026 - 21:08

Source

The post Replacement turbine blades arrive at one of Australia’s oldest wind farms appeared first on Renew Economy. |

Your Democracy

Monday, February 16, 2026 - 17:02

Source

They like the bedtime story: Europe was peacefully humming along in its post-history spa — open borders, cheap energy, NATO as a charity, Russia as a gas station with a flag… and then, one day, the barbarian kicked the door in for no reason at all. That story is not just dishonest. It’s operational. It’s the propaganda you tell yourself so you can keep the addiction going without ever admitting how self-destructive it is.

|

|

John Quiggin

Monday, February 16, 2026 - 15:03

Source

Another Monday Message Board. Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please. |

Renew Economy

Monday, February 16, 2026 - 14:46

Source

The post Major capital raise seeks $450 million to “lead New Zealand’s renewable energy future” appeared first on Renew Economy. |

|

Renew Economy

Monday, February 16, 2026 - 14:38

Source

The post Solar-battery hybrid and CIS winner gets super quick federal green tick appeared first on Renew Economy. |

Renew Economy

Monday, February 16, 2026 - 14:33

Source

The post State LNP promises “strict new audits” of solar and wind, Barnaby promises a big new coal plant appeared first on Renew Economy. |

|

Your Democracy

Monday, February 16, 2026 - 14:07

Source

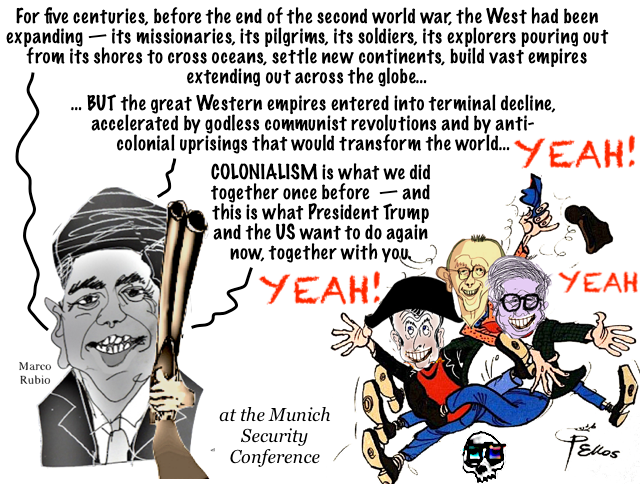

UNITED STATES Secretary of State Marco Rubio gave the green light to European leaders for a new era of colonialism. Speaking at the Munich Security Conference on Saturday, Mr Rubio offered partnership between the US and Europe to recolonise the global South.

Rubio gives green light to new era of US-European colonialism |

MacroBusiness

Monday, February 16, 2026 - 14:00

Source

With less than five weeks to go until the South Australian election, the Opposition Liberal Party has announced a stamp duty concession to help older homeowners downsize. It is not a full exemption but a one‑off $15,000 discount on stamp duty for eligible buyers. The concessions would be available to South Australians aged 55 and The post Cutting stamp duty for older Australians is unfair appeared first on MacroBusiness. |

|

MacroBusiness

Monday, February 16, 2026 - 12:30

Source

Australia is experiencing a major economic shift driven by a decade-long surge in federal and state government spending: Economists claim government spending is now structurally reshaping the economy in a way comparable to the early‑2000s mining boom. Alex Joiner, chief economist at IFM Investors, clearly illustrates the shift from the mining boom to the government-spending |

Renew Economy

Monday, February 16, 2026 - 12:27

Source

The post “We don’t doubt ourselves:” Fortescue’s race to real zero – and the radical rethink behind it appeared first on Renew Economy. |

|

Renew Economy

Monday, February 16, 2026 - 12:05

Source

The post Can inverter-based technologies do the system security job of big spinning machines? appeared first on Renew Economy. |

MacroBusiness

Monday, February 16, 2026 - 12:00

Source

Apparently, Lenore Taylor, editor at the fake left Guardian, has jumped off the ship. Guardian Australia editor Lenore Taylor’s decision to step down this week after almost 10 years in the job wasn’t a shock. But the timing sure was. Announcing it at 5.30pm on a Tuesday? Leaving the business the following day? And staff hearing The post Guardian editor shoved for growing One Nation? appeared first on MacroBusiness. |

|

MacroBusiness

Monday, February 16, 2026 - 11:30

Source

The Australian Treasury set aside $35.7 million in contingent liabilities for defaults under the federal government’s 5% deposit scheme for home buyers in the mid-year budget update in December. Under this scheme, the Treasury guarantees 15% of first-home buyer mortgages, allowing homes to be purchased with only a 5% deposit without requiring lenders’ mortgage insurance. |

MacroBusiness

Monday, February 16, 2026 - 11:00

Source

Goldman believes that after accounting for seasonal fluctuations, the weighted average property price in the Chinese primary market decreased by 5.3% on an annualized basis in January, according to NBS 70-city data. Prices varied widely among city tiers. NBS and third-party platforms’ secondary market data indicate price decreases of 10% to 25% throughout the previous The post Chinese property bust worsens appeared first on MacroBusiness. |

|

xkcd.com

Monday, February 16, 2026 - 11:00

Source

|

MacroBusiness

Monday, February 16, 2026 - 10:30

Source

On Thursday, I was interviewed by Mark Levy at Radio 2GB regarding Labor’s changes to the taxation of earnings on large superannuation balances. If passed by the Senate, the tax rate on superannuation accounts with balances between $3 million and $10 million will double to 30% from 1 July 2026. The tax rate on superannuation The post Superannuation was never meant to be a tax shelter appeared first on MacroBusiness. |

|

MacroBusiness

Monday, February 16, 2026 - 10:00

Source

NDX in for a test of the trading range. Charts from TME. The Sag7 does not look well. CTA uh oh. Bond volatility is on the rise. Which equities hate. The software route has not followed through on the squeeze. DEspite being cheap, cheap. The example of early AI casualties in India is instructive. No The post Michael Hartnett completely lost in China appeared first on MacroBusiness. |

Your Democracy

Monday, February 16, 2026 - 09:42

Source

The “woke, decadent” EU is not facing a decline regardless of what critics say, and some people, including nearly half of Canadians, “still want” to join it, the bloc’s foreign policy chief Kaja Kallas has claimed. |

|

MacroBusiness

Monday, February 16, 2026 - 09:30

Source

Following the resignation of former Liberal Party leader Sussan Ley, her rural New South Wales seat of Farrer will go to a byelection. To say the situation is problematic for newly minted Liberal Party leader Angus Taylor would be an understatement. Instead of Ley remaining in parliament to see out her term or waiting until The post One Nation’s huge test appeared first on MacroBusiness. |

MacroBusiness

Monday, February 16, 2026 - 09:00

Source

The new opposition leader, whom we didn’t even bother reporting on, failed day one. “We have to do better, there’s no question about that,” he told Sky News on Sunday, adding in relation to Ley that he “sought to be a supporter of her leadership, every single day”. He said the opposition’s focus in the The post Start the countdown to Andrew Hastie appeared first on MacroBusiness. |

|

Renew Economy

Monday, February 16, 2026 - 08:02

Source

The post Carbon price no longer “electoral kryptonite,” survey finds appeared first on Renew Economy. |

MacroBusiness

Monday, February 16, 2026 - 08:00

Source

The ferrous jaws are all but closed after a Friday flush. CISA early February data was out and was not good. We are well below 2025 output here, though the later CNY is playing a role. Steel inventories climbed 2.7%. As you can see, mills are about to pile it up over the Chinese New The post Uh oh. China runs out of room for iron ore appeared first on MacroBusiness. |

CS Energy is using its coal plant byproducts quite literally to build a bridge between its traditional fossil generation business and its renewable energy future.

CS Energy is using its coal plant byproducts quite literally to build a bridge between its traditional fossil generation business and its renewable energy future.

Hydro Tasmania has successfully delivered replacement turbine blades to one of Australia’s oldest continuously working wind farms.

Hydro Tasmania has successfully delivered replacement turbine blades to one of Australia’s oldest continuously working wind farms.

New Zealand gentailer woos investors from home and across the ditch to help fund its ambitious renewable energy development plans.

New Zealand gentailer woos investors from home and across the ditch to help fund its ambitious renewable energy development plans. Solar and battery project proposed for central northern Victoria gets EPBC all-clear just four months after joining the queue.

Solar and battery project proposed for central northern Victoria gets EPBC all-clear just four months after joining the queue.  Nothing says election year like a big new push for division around renewables. In Victoria, the opposition Coalition and One Nation are getting busy courting votes.

Nothing says election year like a big new push for division around renewables. In Victoria, the opposition Coalition and One Nation are getting busy courting votes.

Iron ore giant Fortescue has just four years left to meet its real zero emissions by 2030 target, a mammoth task that will require it to fundamentally change how it operates. So can it be done?

Iron ore giant Fortescue has just four years left to meet its real zero emissions by 2030 target, a mammoth task that will require it to fundamentally change how it operates. So can it be done? A new white paper examines how Australia can ensure electricity system security in the transition from baseload generators and spinning machines to a grid dominated by inverter-based resources.

A new white paper examines how Australia can ensure electricity system security in the transition from baseload generators and spinning machines to a grid dominated by inverter-based resources.

An ex-Labor strategist turned pollster says there are votes in taxing Australia's biggest polluters through reframing the debate and evolving demographics.

An ex-Labor strategist turned pollster says there are votes in taxing Australia's biggest polluters through reframing the debate and evolving demographics.